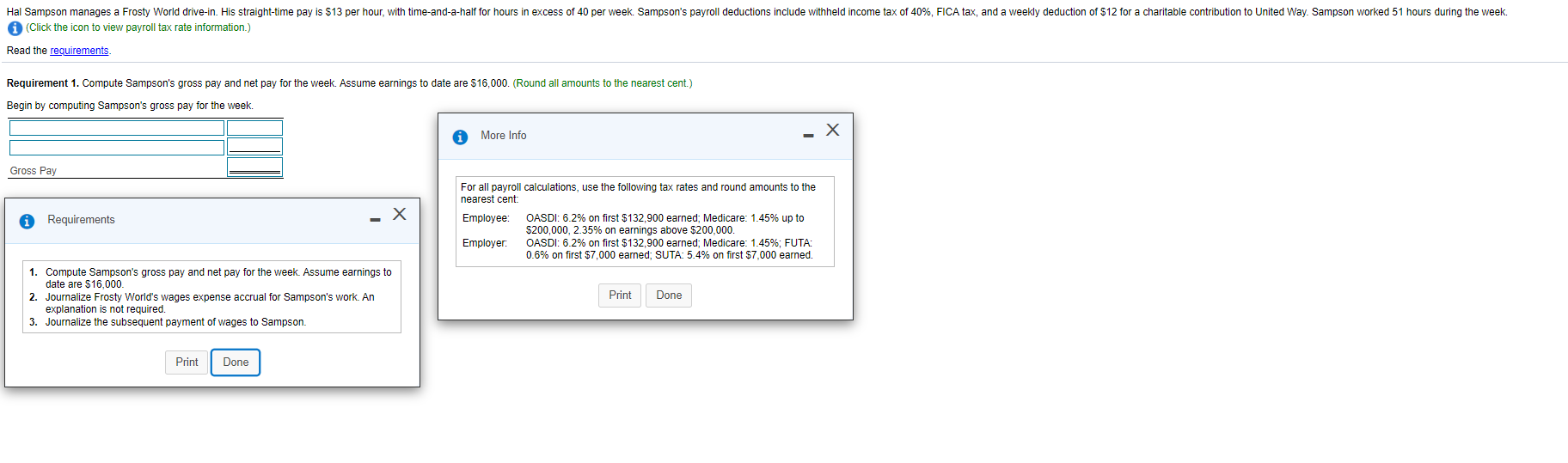

13 dollars an hour 40 hours a week after taxes

Web The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. If your hourly rate is 13 you will have a gross income of 27040 a year.

Free Paycheck Calculator Hourly Salary Take Home After Taxes

Heres how we did the math.

. If you are working a full-time job you will. Web 20 dollars an hour is 41600 a year before taxes. The following table shows what an hourly wage earner would make per week for 20 30 40 hour work weeks.

A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week. Do the math yourself and then deduct a gross amount of about 28 for the different taxes that are deducted from your gross earnings to learn what is your take. Please note these numbers are.

40 hours of work per week multiplied by 52 the of weeks in a year equals. His income will be. See where that hard-earned money goes - Federal Income Tax Social.

This assumes you are working 40. Web Earnings after tax EAT is the measure of a companys net profitability. Typically the average workweek is 40 hours and you can work 52 weeks a year.

Web In the equation the 18 stands for 18 dollars an hour 40 means 40 hours a week and 52 stands for 52 weeks in a year. Web Breakdown of 13 Dollars an hour is how much a year. Web Making 13 dollars an hour is 27040 a year.

Web To calculate how much you will get paid per year lets assume you work 52 weeks of the year with 2 weeks paid time off. Take 40 hours times 52. Web If you make 13 dollars an hour how much do you make a year if you work 40 hours a week.

18 an hour before taxes is equal to 135 an hour. If you work 13 hours a week for 6 weeks how much money would you. 10hour is in the bottom 10 of wages in the United States.

Hourly wage 2500 Daily wage 20000. It is calculated by subtracting all expenses and income taxes from the revenues the business. Web Answer 1 of 7.

Web As a part-timer working 40 total hours every 2 weeks 13 4 hours 5 daysweek 2 weeks you are entitled to get 520 before taxes. Web Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 2400 after taxes.

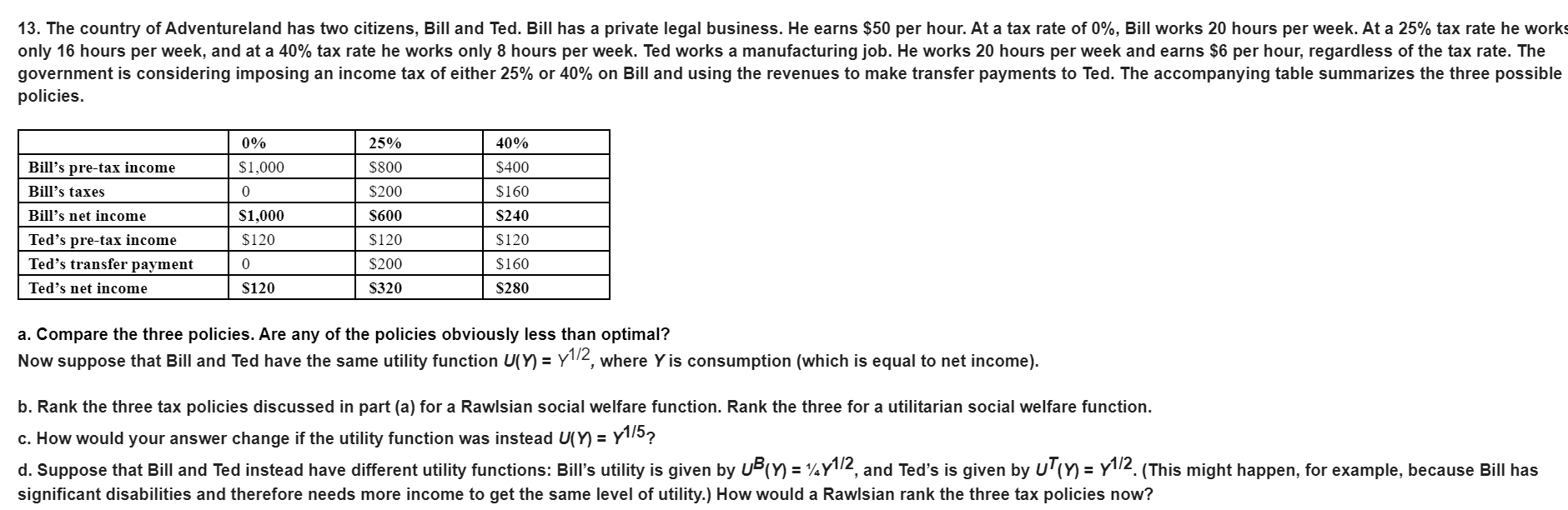

Solved Hal Sampson Manages A Frosty World Drive In His Chegg Com

Hourly Paycheck Calculator Calculate Hourly Pay Adp

The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay Saez Emmanuel Zucman Gabriel 9781324002727 Amazon Com Books

85 000 A Year Is How Much An Hour Zippia

The 2022 Long Term Budget Outlook Congressional Budget Office

Every Electric Vehicle Tax Credit Rebate Available By State

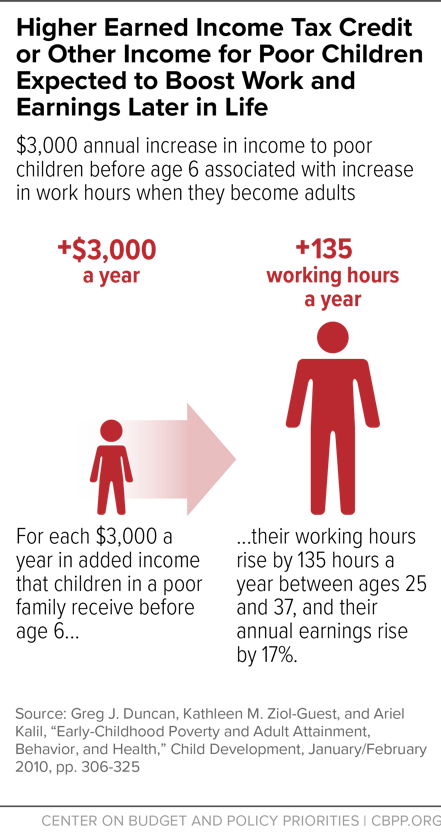

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Ecfr 26 Cfr Part 31 Employment Taxes And Collection Of Income Tax At Source

A Complete Guide To New York Payroll Taxes

13 An Hour Is How Much A Year Hovering Near Minimum Wage Money Bliss

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

15 An Hour Is How Much A Year Stack Your Dollars

Most Important Form You Ll Fill Out At Work Affects How Much Money You Take Home In Each Paycheck Understand It And Fill It Out Correctly First Day Ppt Download

Biden S Minimum Wage Exaggeration Factcheck Org

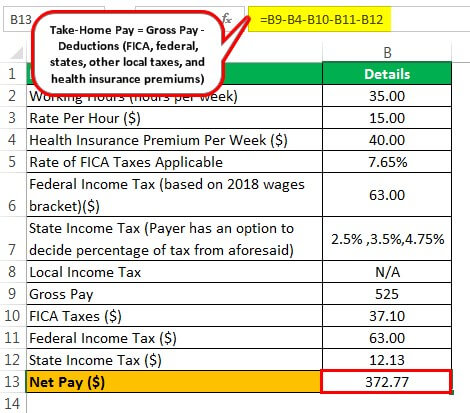

Take Home Pay Definition Example How To Calculate

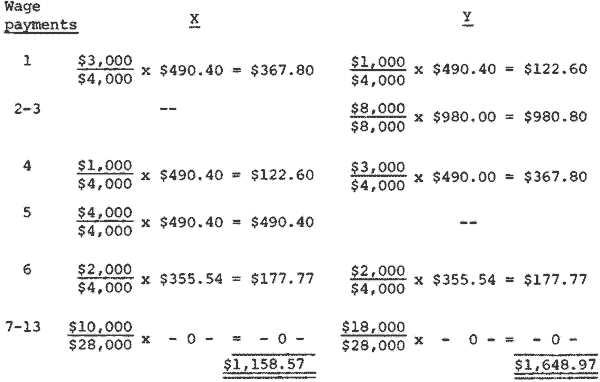

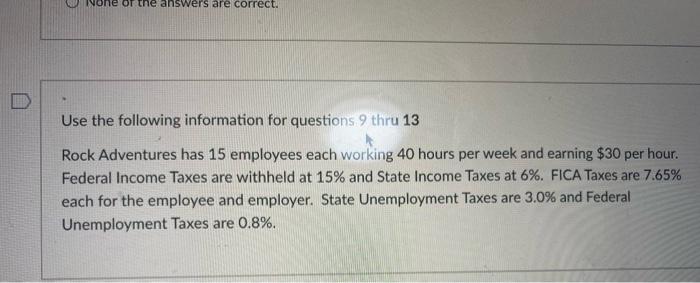

Solved He Or The Answers Are Correct Use The Following Chegg Com

Hourly Salary To Weekly Paycheck Conversion Calculator

State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities